When you are just starting out on your export journey, there seems no end of opportunity. All you need to do is find a few distributors and off you go. Little or no cost and limitless returns?!

Unfortunately, the reality is much harder than it seems. There are many pitfalls to avoid. Targeting the right market and finding the best partner are both critical. Make the wrong choices and it can end up costing you $000s and even threaten your whole export journey.

What can go wrong?

- You target the wrong market and spend a lot of money trying to enter when other countries offer a better opportunity

- Your products/services are not suitable for the target market

- Your business is not properly prepared to handle export orders

- You try to cover too many countries in one go and end up just scratching the surface of the market, never really making progress

- You sign up a distributor, but they do nothing to promote your products/services, resulting in low or even zero sales

- Your distributor does not have the right contacts in your market sector to best represent your products/services in the market

- Your distributor does not have the resources to allocate to promote your products/services

- Your distributor or an associated company represents competing or conflicting products

Any one of these issues, or worse a combination of them, can derail your export journey before it really starts and cost you a lot of money.

This is where an experienced export consultant comes in. We can help you make the right choices from the beginning. Making sure the basics are right, assessing the opportunities, planning your export strategy, identifying and evaluating the right partners and distributors for your business, are all critical.

The costs of using a consultant can seem high initially but view it as an investment in your future business. The results of our input will be felt for years to come. Some businesses work with the right distributor for 20-30 years! Building successful partnerships can reap high rewards over time.

You would view an investment in plant and machinery or computers as essential for your business and write off the cost over several years.

Similarly, consultancy is an intellectual asset for your business, an investment that will bring returns over and over again, long after the project is complete.

So, when assessing the price of consultancy look at the costs and returns over a 5 – 10 year period.

As an additional peace of mind, we GUARANTEE to meet agreed outputs and KPIs or your MONEY BACK

So, you have everything to gain and nothing to lose.

We look forward to working with you.

Has your business deferred Customs Declarations since the start of last year?

If so, you have 175 days from the date of import to submit the full declaration. That time is nearly up. You or your customs agent must file with HMRC within that deadline.

Do you or they have the capacity to cope with the volume of entries required? Do you need additional support?

Go Exporting is pleased to offer our Customs Agency service to take up the excess. Don’t be caught out. We can help.

Contact us today for a no-obligation discussion on your requirements and how we can ease your Customs Declarations headaches!

On 26th and 27th January, we’ll be joining Enterprise Nation for a special Amazon Bootcamp.

The free educational online event will teach participants how to sell products globally, with sessions on marketplace essentials, guidance on shipping to the USA and selling into Europe after Brexit.

The Amazon Small Business Accelerator Boostcamp is free to join and will require a commitment of seven hours learning time over the two days where participants will also receive a certificate of completion.

Sign-up for this live Bootcamp and learn more about the agendas on both days here.

Join us between January 26th – 28th for Emerging Tech Fest 2021, Wales’ leading emerging technology conference.

Delivered by CEMET, Innovate UK, KTN and Technology Connected, the three-day event will showcase some of the most exciting technology in Wales and beyond.

Go Exporting CEO, Mike Wilson, will be delivering a sesson on 27th at 11:45am on exporting goods and services to the EU, covering what changed on 1st January and answering your questions.

Hosted virtually, key speakers will share thought leadership, you can create valuable connections and learn how the tech sector is transforming lives and industries.

“Following a turbulent year, this conference aims to leave you feeling inspired and full of knowledge on the opportunities available for your business using emerging technology. There is a wealth of support available and multiple communities working together unlocking the power of emerging technology, join us to find out how your business can achieve the same.”

Learn more about the event, see the full programme and register to attend here.

At almost the last minute, the trade deal between the EU and UK has been agreed by the negotiators. It just now needs ratifying by the respective parliaments, which may be a challenge. EU ambassadors have given their OK and the UK parliament will discuss this week.

As in any discussion, not everyone will have gained everything they wanted, but broadly the deal seems to be positive for trade between the parties. The avoidance of duties and quotas on goods can only be applauded and a collective sigh of relief for all exporters and importers.

In previous articles, we have written about the hidden threat of Rules of Origin. This also seems largely to have been resolved with an agreement on full bilateral cumulation which allows EU inputs and processing to be counted as UK inputs in UK products exported to the EU, and vice versa. This is an extremely important simplification which will avoid countless headaches and supply chain issues.

So, all relatively positive, but considerable changes to the way the EU and UK trade with each other will nevertheless come into effect from 1st January 2021. If you are one of those companies who were hoping it would all go away with a trade deal or were waiting for certainty before finalising your planning for Brexit, well now is the time to get ready. There are still significant changes coming for your business which cannot be avoided.

Some of the important procedures and requirements you need to be ready for are:

- EORI Numbers including the XI number for Northern Ireland

- Customs Declarations on all imports and exports

- Changes to licence and certificate requirements, such as sanitary and phytosanitary rules

- Rules of Origin – there may be an agreement on bilateral cumulation, but you still need to understand the requirements to prove and indicate the origin of your product.

- VAT Changes – do you need a local Vat number and fiscal representative, changes to MOSS

- Incoterms – have you agreed with your customers and suppliers the exact terms of future trade? Don’t get caught out with charges you were not expecting.

- Approvals and UKCA/CE Marking – are you aware of the changes and requirements for your products?

- Who is going to be the Importer of Record and are they prepared for the implications and responsibilities? Would you benefit from an Authorised Representative?

- Do you sell via eCommerce across borders? Are you aware of the implications for VAT, for data handling etc

We could go on, but you get the picture. There is a lot of change coming and you need to be ready for it.

Go Exporting can help you prepare for Brexit with our FastTrack Review. We look specifically at the implications for your business and provide you with a detailed action plan to follow. If you are not ready, you will need to act fast to avoid disruption to your business.

Call us today on 0800 689 1423 for fast turnaround support to prepare your business. Then let’s start looking forward to taking advantage of the new world of opportunities that are about to emerge.

It is widely acknowledged that Brexit is going to present significant challenges for British international trade, irrespective of whether we reach a Free Trade Agreement with the EU before the end of the transition period. That in itself is looking an ever more remote possibility with both parties playing hardball and the UK Government’s unprecedented threat to break international law.

One post-Brexit change in international trade causing palpitations in some businesses is one you may not have heard of, or not considered a real threat – Rules of Origin.

What are Rules of Origin?

Think of Origin as the ‘Economic’ nationality of your goods. It is their passport to the way they are dealt with in international trade in terms of duties, standards and compliance with relevant trade agreements. As such Origin can have a profound effect on the viability of your product.

Is origin not obvious?

In this day and age of complex supply chains, defining the Origin of a product can be difficult. It is not where the final goods are shipped from, or even where they are produced, account must be taken of the origin of the components which make up a final product and the work carried out in the country claiming Origin. Many products are made up from raw materials and components sourced from several countries.

Rules of Origin take all these factors into account in order to develop a decision-making framework between countries or economic blocks that are party to a trade agreement, known as Preferential Rules of Origin.

Where an FTA does not exist, the World Trade Organisation (WTO) has guidelines for countries to follow and common duty rates, known as Non-Preferential Rules of Origin.

What is the post-Brexit challenge?

As a member of the EU we have been party to its Free Trade Agreements with many other countries and Economic Pacts around the world. Now we have officially left the EU, when the current transition period ends on 31st December this year we will be trading under Non-Preferential Rules of Origin as part of WTO arrangements unless the Government is able to agree Free Trade Agreements not only with the EU itself but also non-EU countries around the world.

That much has been widely discussed in the press and on television news. What is not mentioned however is that either way Rules of Origin are going to have a potentially devastating impact in terms of confirming a product is British. It is estimated that associated administration and compliance costs could run from 4 – 15% of the good value. This is in effect a hidden duty.

Within the EU any materials or components sourced from another EU country are classed as ‘national’. In effect this means that if a product has 70% of its components sourced from France or Germany for example and is then assembled in the UK, it has EU origin in the eyes of other EU countries and all other countries where the EU has a trade agreement. Consequently, it qualifies for preferential tariffs.

Once outside of the EU, typically FTAs require at least 50% local content in order to confer origin. In our example above, therefore, the product would not qualify as British, meaning it would fall under WTO Non-Preferential rules and tariffs.

How big a problem is this?

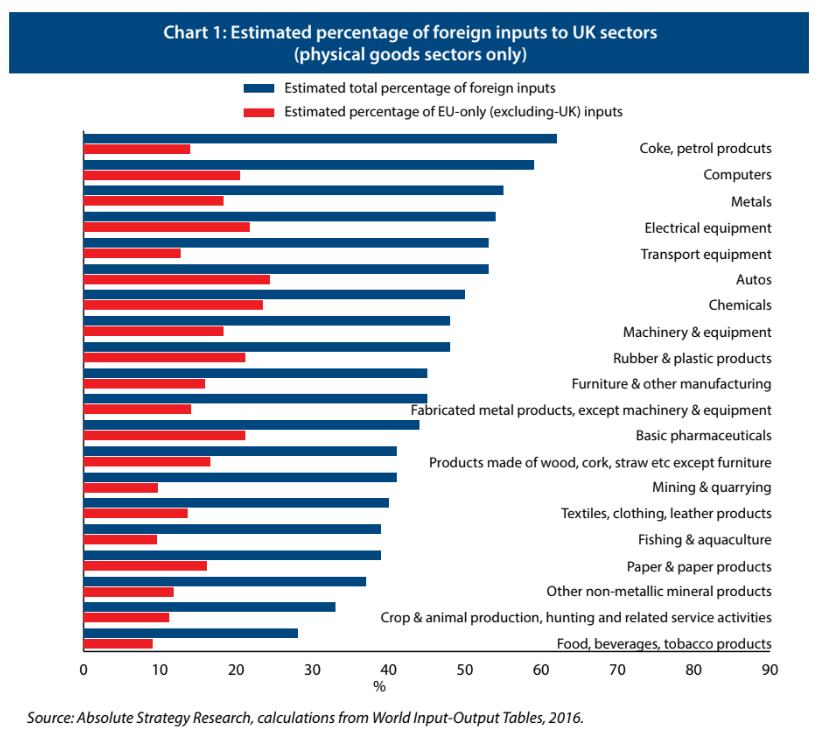

This is an issue which could well affect many UK industries as shown by the table below. Computers, metals auto are all important examples where external components are estimated to be above 50% of the total.

Mike Hawes, Chief Executive of the Society of Motor Manufacturers and Traders, gave evidence to the Business, Energy and Industrial Strategy Select Committee recently. He said that the average car made in the UK uses “20-25 per cent” domestic parts. “To move from where we currently are… to 60 per cent will take many years. There is not necessarily the capability here in the UK”

Even for those businesses with less overseas components and where Origin can be defined as British, significant challenges are looming. Currently around 135,000 UK businesses ONLY export to the EU and have no experience of Rules of Origin. Suddenly they will have significant compliance costs in terms of admin, legal and audit to prove British origin, not to mention potential disruption to international deliveries as customs checks are carried out.

Is there a solution?

To maintain the current status quo on origin would require the Government to achieve a Free Trade Agreement with the EU which allows EU materials and components to count towards British origin as they do now.

In addition, we would need to replicate EU trade agreements with other countries under exactly the same terms so that EU goods count as British.

There are a lot of obstacles to achieving this and it is by no means certain it can be achieved. Tough negotiations lie ahead and time is short if British international trade is not to be significantly impacted.

Read more: UK to follow WTO subsidy rules

As regards the additional costs, there does not seem to be a way around this. FTAs generally set a high bar for proving origin in order to benefit from preferential tariffs. We’ll just have to get used to a more bureaucratic world in international trade post-Brexit!

About Go Exporting:

Go Exporting is a specialist export consultancy that launches businesses just like yours into new international markets. As such we have made it our mission to keep exporters informed about the challenges Brexit will bring and provide support services to help them along the journey.

Whether you have a single question or are looking for a full Brexit audit, we offer cost-effective flexible support.

For further details call +44 (0)800 689 1423; email info@goexporting.com