We are all hopefully aware that Brexit is going to mean changes to the way we export to the EU, in particular with customs declarations, added red tape, Vat changes and so on. But what effect will it have on our relationship with agents and distributors? The obligations, rules and regulations surrounding each will be changing and so you need to review if your current or proposed arrangements are still the best option for your business.

In this article, we will look in more detail at the changes and the implications so you can make an informed choice moving forward.

What is the difference between a distributor and agent?

Often the terms are used to mean the same thing, when in fact there are significant differences. A distributor buys and sells your product in the market, whereas an agent helps you to sell in return for a commission.

A distributor is a company situated in your target country and a specialist in your market sector. They should already have good contacts and existing customers for complementary products. Often, they will stock your product in the country and ship out to customers, making the transaction quick and simple for them. The distributor handles the sales paperwork and agrees the payment terms. The distributor is your customer, sometimes on an exclusive basis.

An agent is similar in that they will be based in your target country and a specialist in your market sector. They should already have good contacts and may represent complementary products. That’s where the similarity ends however. They will open doors to introduce your company and products but the actual sale will be down to you. You handle the marketing, the customer orders from you directly, you agree the payment terms, arrange delivery and support the customer. The agent receives their commission.

We talk in more detail about choosing distributors and agents in our 7-Steps to Export Success e-Book and there is a specific article in our Expert Exporter Resource Hub

What are the implications of Brexit?

In general terms, the UK will no longer be part of the EU Customs Union or Single Market, it become just like any other country trading with the bloc. Customs Declarations will therefore be required, irrespective of whether a Free Trade Agreement (FTA) is agreed or not. The UK also loses access to the EUs FTAs with other countries such as Canada, Japan and more. This all has implications for Rules of Origin and Duties/VAT for starters.

You can find a more detailed discussion of Rules of Origin in our special article below:

Rules of Origin – the greatest Brexit challenge you’ve never heard about

For more details on the impact of Free Trade Agreements click below:

Is an FTA with the EU make or break for the UK economy?

A Distributor will become the Importer

With the changes in legal standing of the UK vs the EU, so changes the legal position of a distributor post-Brexit. The EU will class them as the importer of record and the legal entity presenting the product onto the Single Market. As such this brings additional responsibilities on the distributor. They automatically become what is known as the ‘Responsible Person’ for your product.

The Distributor now becomes responsible for the legal compliance of your product to EU laws and regulations. For example, they must ensure you have done everything correctly in terms of CE marking. This will mean you having to hand-over your products technical file to every distributor. If you have one in every country, that will be 27 to start with! Think of the headaches, not to mention the potential confidentiality and intellectual property issues.

In addition, as the responsible entity in the eyes of EU law, the contact details of the distributor will need to appear on the labelling/packaging of your product. Again, this could mean 27 different labels!

One way around this complexity is to appoint your own Responsible Person or Authorised Representative in the EU to handle your compliance matters. They need to be a legal entity or resident of the EU. Your distributor(s) will also have to legally mandate them to act on their behalf.

Another alternative is to appoint an Initial Importer, who takes on this responsibility and also effectively supplies your distributors, though this can be just a paperwork transaction. If you supply medical devices, under the new MDR regulations the Initial Importer also has additional responsibilities such as recording product complaints.

There are specialist companies offering these services which Go Exporting for example can help you find and appoint. For further details Contact Us here.

An Agent is not the importer

In contrast, an agent does not become the Importer as they are not handling the sales transaction, you are. In effect therefore each customer becomes the importer and takes on the responsibility for ensuring product compliance for example. Will they accept the task? Again, you may decide it is better to appoint your own Responsible Person/Authorised Representative and consider an Initial Importer.

Other challenges

It is important to review your distribution agreement and the terms you have in place. Do they still apply? It may be necessary to amend them based on new Incoterms to make it clear who is responsible for duty and customs arrangements for example.

Ex works terms puts most responsibility on your distributor, but will they want the added complications? Will it spoil the relationship and make them look to EU suppliers instead? You may decide to deliver DDP (Delivered Duty Paid) to take this burden from them but make sure you know the implications and costs, for example can you reclaim the Vat? In many EU countries you will need a Fiscal Representative to have a local Vat number post-Brexit.

Consider delivery times, pricing and stock levels too. Border delays may have an effect, so take this into account to ensure your relationship remains smooth.

Review your Agents contract also. Current EU regulation gives them enhanced rights such as minimum notice periods and the right to compensation or indemnity on increased goodwill. If you end the arrangement this could become very costly. Agents agreements need careful drafting by a suitably qualified legal expert for this very reason. The EU Withdrawal Act commits the UK to retain these agent’s rights, although this may change in the final Brexit deal.

Changes in Practice

Keep your distributor/agent close. Be aware they may look for EU alternatives. It is estimated that 60% have already looked! Did you receive that expected order?

We have seen a hesitance towards entering or renewing agreements with UK suppliers. The key reasons cited are fear of red tape such as customs arrangements, increased currency volatility, uncertainty over the future landscape for standards and approvals, potential delays at port and possible cashflow implications.

A great product or service and perfect execution of orders throughout will help overcome this, however. But don’t be complacent. Discuss with your partners, understand their fears and plan how to overcome them. Make it a priority.

What steps should you take?

The clock is ticking. Everything changes at 11pm on 31st December 2020. Do not delay therefore.

Create a Brexit Planning Checklist – you can download a template here

Discuss and plan your Importer/Responsible Person arrangements

Assess Vat requirements and changes

Review contracts and agreements

Assess market competitiveness

Factor in potential delays at port

Prepare for red tape e.g. customs declarations

Consider Rules of Origin and how they will affect your product/supply chain

KEEP YOUR DISTRIBUTOR/AGENT CLOSE

About Go Exporting:

Go Exporting is a specialist export consultancy that launches businesses just like yours into new international markets. As such we have made it our mission to keep exporters informed about the challenges Brexit will bring and provide support services to help them along the journey.

Whether you have a single question or are looking for a full Brexit audit, we offer cost-effective, flexible support.

For further details call +44 (0)800 689 1423; email info@goexporting.com

With the end of the transition period fast approaching on 31st December this year, we still do not have a Free Trade Agreement (FTA) in place with the EU. Some commentators are hopeful one can be reached but difficult obstacles remain surrounding fishing rights and Government subsidies. It is still possible the UK could tumble out of the EU without an agreement.

What would that mean for business and the economy? How important is a Free Trade Agreement with the EU? In this article we will explore this subject in more detail.

A Brief History of Free Trade Agreements

Trade Agreements date back to Egyptian times and were widely used, or rather imposed, by the Roman, Ottoman and British Empires. Bilateral agreements on trade interests really started in the 18th Century with Britain at the forefront in promoting the benefits of open trade. The Great Depression revived protectionism, however, and then came the two World Wars. It was only post WW11 that the General Agreement on Tariffs and Trade (GATT) was signed, initially by 23 countries, with the aim of minimising barriers to international trade by eliminating or reducing quotas, tariffs and subsidies.

This led to the creation of the World Trade Organisation (WTO) in 1995, absorbing GATT. The treaty was signed by 125 countries covering 90% of world trade. Today the WTO has 164 members and reaches 98% of world trade. Its role is to regulate and monitor trade in goods, services and intellectual property between members. It sets agreed maximum tariffs for what is known as Most Favoured Nation (MFN) status. Members agree that they will not discriminate in terms of trade between other MFNs. So, the tariffs they charge are the same for all countries. That is unless there is an FTA in place between two or more countries. Such agreements are allowed by the WTO providing they do not worsen the pre-agreement situation for non-FTA countries.

This has led to the growth of Bilateral FTAs and most recently Plurilateral or Regional FTAs, of which the EU is a complex example.

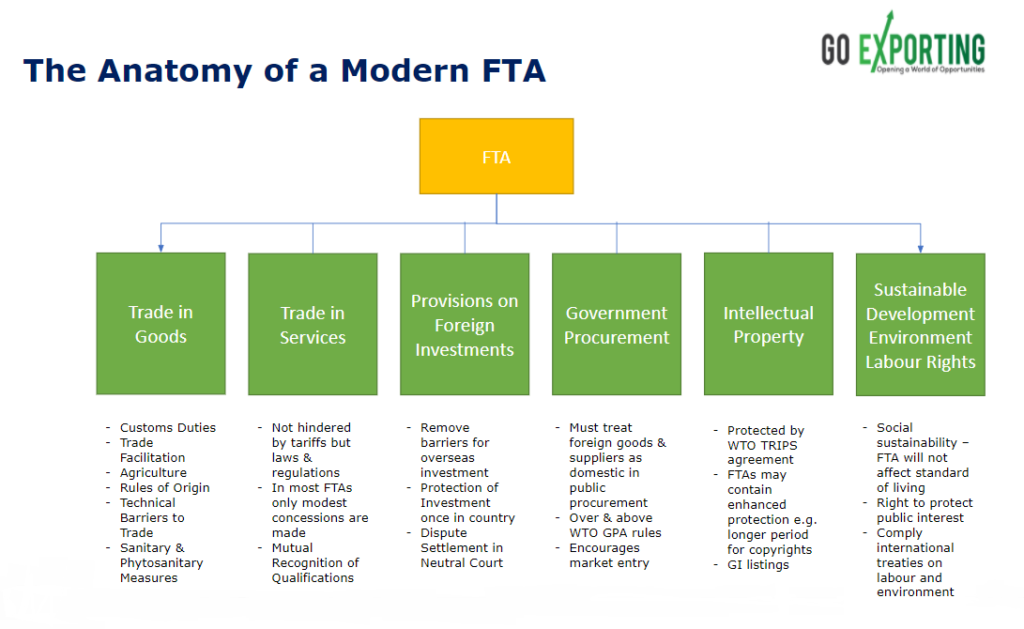

The Anatomy of a Modern FTA

An FTA can be defined as a reciprocal agreement between two or more countries according to international law. It aims to liberalise trade between signatories across substantially all goods and service sectors by easing barriers, reducing or eliminating tariffs and quotas.

The latest FTAs go beyond this however and are often known as Deep Integration FTAs. Good examples are the EU-Japan Economic Partnership Agreement (EPA) and the Comprehensive Economic & Trade Agreement (CETA) between the EU and Canada. Such agreements cover a wide range of topics such as Investment, Intellectual Property, Government Procurement, Technical Standards, Sanitary and phytosanitary standards. The diagram below shows more detail on typical areas covered by such agreements.

As we can see these are detailed and complicated agreements which consequently can take years to negotiate. CETA took 9 years, EU-Japan EPA 6 years, EU-South Korea 9 years, the USA takes on average 5.5 years to conclude an FTA.

What the UK and EU are currently negotiating is this kind of a Deep Integration FTA. Both sides have indicated it needs to be agreed by end of October/early November in order to be ratified in time for the end of the transition period.

On top of that, the UK will not be able to continue to trade with other countries under current EU agreed FTAs. As a non-EU member, the UK is not a signatory. Therefore, it must negotiate its own FTAs with any other country it wishes to trade with on preferential terms.

So, No Pressure!

What is the Importance of FTAs?

Without an FTA with the EU and other major trading partners, the UK will fall back onto WTO rules and tariffs as from 1st January 2021. Compared to the current zero tariffs with the EU, which accounts for around 46% of all UK exports, this could come as quite a shock to many industries. There are over 5200 tariff rates agreed by WTO members, below are a selection of average rates for different sectors.

- Dairy – 37.5 per cent

- Confectionery – 21.2 per cent

- Animal products – 16.3 per cent

- Fish – 11.6 per cent

- Cars and Car Parts – 7%

- Chemicals – 4.6 per cent

- Petrol – 2.5 per cent

- Electrical machinery – 2.3 per cent

- Non-electrical machinery – 1.8 per cent

- Pharmaceuticals – generally 0%

It is clear therefore that outside of an FTA, many UK businesses will become less competitive in international markets due to duties. Agriculture will be particularly hit as can be seen by the tariffs above. FTAs usually lead to significant benefits over WTO rules for this sector. The lack of an FTA will affect both exports and imports, so supply chains will also be a concern.

As we have already seen, deep integration FTAs cover much more than just tariffs, they are designed to reduce barriers to trade too. Without FTAs UK businesses will encounter more red tape for example. Most FTAs agree on simplified procedures for customs, Vat etc. It is already predicted there will be a 6-fold increase in the number of customs declarations required by UK companies. Additional licences and certificates may also be required. This all comes at a cost.

Compliance and product certification will also be an area of concern. The UK has announced it will adopt a new UK Conformity Assessed (UKCA) as from 2021 which will cover most of the same products as the current European CE marking. There will be a CE transition period until the end of the year but after that CE may not be recognised in the UK in the same way. Equally UKCA will not be recognised by the EU. To sell in both areas therefore will require both certifications. Taking this a stage further, CE conformity assessments carried out by UK notified bodies may not be recognised by the EU. It is important to check this point with your assessment organisation.

As we have seen, FTAs always include an agreement on Rules of Origin. UK companies will now have to prove UK origin rather than EU origin for their products. With today’s complex supply chains, this could be more difficult than it sounds. In fact, it is reckoned Rules of Origin is the biggest Brexit challenge for many businesses. See our in-depth article on this subject here.

Is it Make or Break for the UK?

As with all questions of this kind, there is no black and white answer. Many countries do trade quite happily on WTO terms, although the growth of regional trade agreements such as the Transatlantic Trade & Investment Partnership (TTIP), Trans-Pacific Partnership (TPP) and Regional Cooperation in Asia & Pacific (RCEP) makes the number smaller almost by the day.

What is for sure, is that UK businesses will be exposed to higher duties and increased costs in order to comply with new trading terms and conditions. The new normal will be a hard learning curve and some will suffer. UK companies have proven themselves to be resilient, however. Many will find a way.

Brexit will also bring exciting opportunities as well as the challenges. See our special article ‘Brexit: the greatest business opportunity for a generation?’ for more details.

That said, let’s all hope the UK and EU reach a consensus and there is a smooth transition into 2021 and the post-EU reality.

About Go Exporting:

Go Exporting is a specialist export consultancy that launches businesses just like yours into new international markets. As such we have made it our mission to keep exporters informed about the challenges Brexit will bring and provide support services to help them along the journey.

Whether you have a single question or are looking for a full Brexit audit, we offer cost-effective flexible support.

For further details call +44 (0)800 689 1423; email info@goexporting.com

Earlier this month we joined Business Wales for a webinar series supporting local companies to navigate Brexit and the road ahead.

This episode looks at free trade agreements, including what they are, which post-Brexit FTA’s are in place already and where agreements may be reached soon, what trade agreements mean for your export strategy and how to assess market potential after the end of the transition period.

Watch the webinar in full below and watch even more great business advice content over on Business Wales’ YouTube channel here.

Businesses in the UK are still critically unprepared for the end of the transition period, with fewer firms conducting risk assessments and many unanswered questions remaining on what lies ahead.

According to The British Chambers of Commerce’s Brexit guidance dashboard, of 35 questions that businesses are asking on Brexit, 26 remain unanswered, including key areas such as recruitment, investment and labelling of food and drink.

The Chambers has also conducted new research into the Brexit-readiness of UK companies and found that the rate at which risk assessments were being carried out has dropped too. Last year, almost six in 10 firms had conducted a Brexit audit. This year, with the pandemic largely to blame, that number has fallen to under four in 10.

Less than half of businesses have taken the government’s recommended eight steps to get Brexit-ready for changes in the movement of goods between the UK and EU, including key operational fundamentals for trading such as customs declarations and impacts to customers and suppliers.

Director General of the British Chambers of Commerce, Adam Marshall, commented on the recent updates that: “With just 98 days to go, business communities face the triple threat of a resurgent Coronavirus, receding government support schemes, and a disorderly end to the transition period.

“Significant unanswered questions remain for businesses, and despite recent public information campaigns, base levels of preparedness are low. Many firms say they’ve heard talk of deadlines and cliff edges before, and others are still grappling with fundamental challenges as a result of the pandemic and have little cash or information with which to plan.”

Read more: The greatest Brexit challenge you’ve never heard about

“While we recognise that some of the questions facing businesses are subject to ongoing negotiations between the government and the EU, other matters are within the UK’s own hands. The government must ramp up engagement with business urgently – to the levels seen prior to previous ‘no deal’ deadlines – to ensure that the real-world issues facing firms get tackled immediately.

“The ‘Check, Change, Go’ campaign gives the impression that Brexit-related changes are like getting an MOT – whereas the reality is that for many businesses, they’re more akin to planning a moon landing. Businesses need honest communication about the complexity of the changes they face – and stronger encouragement to act.”

Now is the time to conduct a Brexit audit of your businesses

The good news for UK firms is that, despite there being less than 13 weeks to go until the end of the transition period, there is still time to act.

A Brexit audit can reduce the risk to businesses, help avoid skills shortages and plan for new paperwork requirements – as well as assessing your current export strategy and analysing new potential opportunities.

Whilst mitigating the damage being caused by the global pandemic rightly takes immediate priority, the Government has confirmed on numerous occasions that Brexit will not be delayed.

So, FastTrack your company’s international growth and spot the threats and opportunities that leaving the EU will deliver through our Brexit consultancy services.

It is widely acknowledged that Brexit is going to present significant challenges for British international trade, irrespective of whether we reach a Free Trade Agreement with the EU before the end of the transition period. That in itself is looking an ever more remote possibility with both parties playing hardball and the UK Government’s unprecedented threat to break international law.

One post-Brexit change in international trade causing palpitations in some businesses is one you may not have heard of, or not considered a real threat – Rules of Origin.

What are Rules of Origin?

Think of Origin as the ‘Economic’ nationality of your goods. It is their passport to the way they are dealt with in international trade in terms of duties, standards and compliance with relevant trade agreements. As such Origin can have a profound effect on the viability of your product.

Is origin not obvious?

In this day and age of complex supply chains, defining the Origin of a product can be difficult. It is not where the final goods are shipped from, or even where they are produced, account must be taken of the origin of the components which make up a final product and the work carried out in the country claiming Origin. Many products are made up from raw materials and components sourced from several countries.

Rules of Origin take all these factors into account in order to develop a decision-making framework between countries or economic blocks that are party to a trade agreement, known as Preferential Rules of Origin.

Where an FTA does not exist, the World Trade Organisation (WTO) has guidelines for countries to follow and common duty rates, known as Non-Preferential Rules of Origin.

What is the post-Brexit challenge?

As a member of the EU we have been party to its Free Trade Agreements with many other countries and Economic Pacts around the world. Now we have officially left the EU, when the current transition period ends on 31st December this year we will be trading under Non-Preferential Rules of Origin as part of WTO arrangements unless the Government is able to agree Free Trade Agreements not only with the EU itself but also non-EU countries around the world.

That much has been widely discussed in the press and on television news. What is not mentioned however is that either way Rules of Origin are going to have a potentially devastating impact in terms of confirming a product is British. It is estimated that associated administration and compliance costs could run from 4 – 15% of the good value. This is in effect a hidden duty.

Within the EU any materials or components sourced from another EU country are classed as ‘national’. In effect this means that if a product has 70% of its components sourced from France or Germany for example and is then assembled in the UK, it has EU origin in the eyes of other EU countries and all other countries where the EU has a trade agreement. Consequently, it qualifies for preferential tariffs.

Once outside of the EU, typically FTAs require at least 50% local content in order to confer origin. In our example above, therefore, the product would not qualify as British, meaning it would fall under WTO Non-Preferential rules and tariffs.

How big a problem is this?

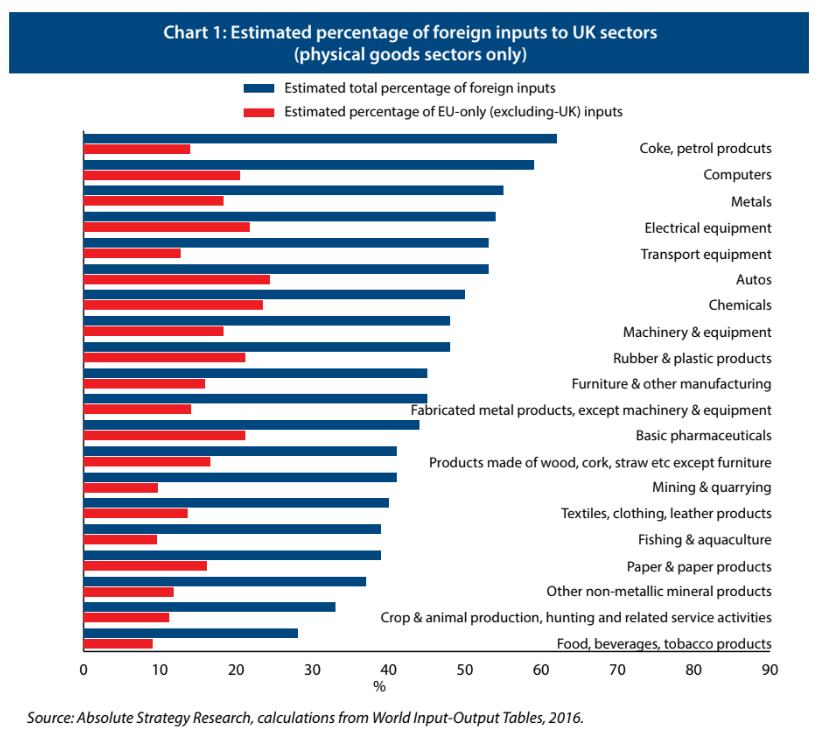

This is an issue which could well affect many UK industries as shown by the table below. Computers, metals auto are all important examples where external components are estimated to be above 50% of the total.

Mike Hawes, Chief Executive of the Society of Motor Manufacturers and Traders, gave evidence to the Business, Energy and Industrial Strategy Select Committee recently. He said that the average car made in the UK uses “20-25 per cent” domestic parts. “To move from where we currently are… to 60 per cent will take many years. There is not necessarily the capability here in the UK”

Even for those businesses with less overseas components and where Origin can be defined as British, significant challenges are looming. Currently around 135,000 UK businesses ONLY export to the EU and have no experience of Rules of Origin. Suddenly they will have significant compliance costs in terms of admin, legal and audit to prove British origin, not to mention potential disruption to international deliveries as customs checks are carried out.

Is there a solution?

To maintain the current status quo on origin would require the Government to achieve a Free Trade Agreement with the EU which allows EU materials and components to count towards British origin as they do now.

In addition, we would need to replicate EU trade agreements with other countries under exactly the same terms so that EU goods count as British.

There are a lot of obstacles to achieving this and it is by no means certain it can be achieved. Tough negotiations lie ahead and time is short if British international trade is not to be significantly impacted.

Read more: UK to follow WTO subsidy rules

As regards the additional costs, there does not seem to be a way around this. FTAs generally set a high bar for proving origin in order to benefit from preferential tariffs. We’ll just have to get used to a more bureaucratic world in international trade post-Brexit!

About Go Exporting:

Go Exporting is a specialist export consultancy that launches businesses just like yours into new international markets. As such we have made it our mission to keep exporters informed about the challenges Brexit will bring and provide support services to help them along the journey.

Whether you have a single question or are looking for a full Brexit audit, we offer cost-effective flexible support.

For further details call +44 (0)800 689 1423; email info@goexporting.com

The Department for Business has confirmed that the UK will follow World Trade Organisation (WTO) rules regarding subsidies following the end of the transition period, replacing EU state aid laws from January 1st.

The rules will cover financial assistance granted by governments and public bodies to businesses, something which has become a sticking point during the latest round of EU/UK trade deal talks.

The WTO subsidy rules are internationally recognised as the common standard, covering financial assistance given to private firms. However, unlike EU member states, most other advanced economies don’t have rules regulating these subsidies – beyond those set by the World Trade Organisation.

Currently, the European Commission policies state subsidies to businesses to ensure no distortion of competition regulations between EU member states within the single market – something which the UK will no longer be bound to next year – allowing the creation of its’ own subsidy control regime.

Yet despite having more freedom in this area, business secretary Alok Sharma said the government has no plans to return to a 1970’s approach of trying to run the economy or bailing out unsustainable firms.

He said that: “We want a competitive, dynamic market economy in which we can back British industries to create more jobs in this country, while also making the UK the best possible place to start and grow a business.

“While our guiding philosophy remains that we do not want a return to the 1970s approach of picking winners and bailing out unsustainable companies with taxpayers’ money, the UK must have flexibility as an independent, sovereign nation to intervene to protect jobs and to support new and emerging industries now and into the future.”

Read more: Johnson gives trade deal ultimatum as Barnier sets to touchdown for next round of talks

“As we take back control of our money and laws from the EU, we have a unique opportunity to design our own subsidy control regime in a way that works businesses, workers and consumers.

“Over the coming months, I want to work closely with businesses and public authorities across all parts of the United Kingdom to consider how best we can use these new freedoms.”

Further guidance will be published before the end of the year.

Prime Minister Boris Johnson has upped the stakes on the eve of the eighth round of trade talks between the UK and EU by stating that a lack of a free trade deal agreement by mid-October would mean no trade deal.

Brexit is very much back on the agenda with a bump as EU diplomats explained their irritation at the UK’s stance, slightly dismissing it as ‘muscle-flexing’ and ‘self-defeating’ as talks enter the final weeks.

Two key issues remain which neither party is looking likely to make concessions over – that of access to UK fishing waters and rules regarding government intervention in struggling businesses.

In a statement on Facebook, Johnson stated that: “We are now entering the final phase of our negotiations with the EU.

“The EU have been very clear about the timetable. I am too. There needs to be an agreement with our European friends by the time of the European Council on 15 October if it’s going to be in force by the end of the year. So there is no sense in thinking about timelines that go beyond that point. If we can’t agree by then, then I do not see that there will be a free trade agreement between us, and we should both accept that and move on.

“We will then have a trading arrangement with the EU like Australia’s. I want to be absolutely clear that, as we have said right from the start, that would be a good outcome for the UK. As a Government we are preparing, at our borders and at our ports, to be ready for it. We will have full control over our laws, our rules, and our fishing waters. We will have the freedom to do trade deals with every country in the world. And we will prosper mightily as a result.

“We will of course always be ready to talk to our EU friends even in these circumstances. We will be ready to find sensible accommodations on practical issues such as flights, lorry transport, or scientific cooperation, if the EU wants to do that. Our door will never be closed and we will trade as friends and partners – but without a free trade agreement.

“There is still an agreement to be had. We will continue to work hard in September to achieve it. It is one based on our reasonable proposal for a standard free trade agreement like the one the EU has agreed with Canada and so many others. Even at this late stage, if the EU are ready to rethink their current positions and agree this I will be delighted. But we cannot and will not compromise on the fundamentals of what it means to be an independent country to get it.”

Read more: Brexit deal ‘seems unlikely’ this year

Earlier, the UK’s lead negotiator David Frost told the Mail on Sunday that the UK was more than ready to walk away from negotiations.

“We came in after a Government and negotiating team that had blinked and had its bluff called at critical moments and the EU had learned not to take our word seriously,” he said.

“So a lot of what we are trying to do this year is to get them to realise that we mean what we say and they should take our position seriously.”

The Government is being urged to make good on its’ manifesto pledge to stop the exports of live animals with Brexit affording the best opportunity to push through the relevant regulations.

Up until now, EU laws have stopped the UK banning live exports, and the RSPCA, as well as Conservative ministers, are urging the Government to make the change.

Head of public affairs at the RSPCA, David Bowles, said that: “Leaving the EU is the best chance we have had so far to end the live export trade which causes so much unnecessary suffering to animals.”

Each year, tens of thousands of live animals are exported from the UK to make journeys across Europe, something which ministers are urging action on with lengthy journeys leading to injury, overheating and extreme stress in cramped conditions.

Theresa Villiers, former environment secretary said that leaving the EU is the best chance to take action.

Read more: Trade between UK and EU won’t ‘collapse overnight’ without agreement

She said that: “Now we’re heading for the end of the transition period, we have the opportunity to take action.

“There are some serious legal complexities to be tackled, but there is a clear moral case to end live exports.

“We need to live up to our manifesto commitment on this and restrict excessive long-distance transport of live animals so overseas exports become a thing of the past.”

The latest round of Brexit negotiations has seen talks going backwards according to reports, with EU chief negotiator Michel Barnier saying the chances of striking a deal before the end of the year are looking ‘unlikely’.

With the countdown to the end of the transition period ticking on, the EU has warned that UK negotiators have taken discussions backwards, with issues surrounding fishing and rules surrounding competition seemingly to be two of the main stumbling blocks around the negotiating table.

However, Boris Johnson has urged talks to ‘rapidly accelerate’ over fears of a cliff-edge Brexit – especially on the back of the economic damage seen so far by the coronavirus pandemic.

Barnier has said he is surprised and concerned by the lack of progress, commenting that ‘too often this week t felt as if we were going backwards more than forwards’.

BBC Brussels correspondent Nick Beake believes that both the EU and UK are locked in a last-minute power play, writing that ‘the latest round of discussions were courteous and friendly – with a warmth between the two chief negotiators facing each other – even when each was delivering an uncomfortable message’.

“As ever, the EU and UK are hardly seeing eye-to-eye though.”

However, one UK negotiator has suggested it is the EU that are holding up talks by insisting on agreeing to specific elements of the deal before progressing.

An official commented that: “The process block now is the EU’s insistence that we must accept their position on state aid and fisheries before we can talk about anything else. I mean obviously we’re not going to do that. So it’s frozen.

“Things are focussing down, not necessarily helpfully, on the issues of state aid, subsidy policy and fisheries policy. What’s frustrating here is that Michel Barnier said in his press conference just now, ‘Brexit means Brexit’, which is of course correct. They don’t apply that in this area where they want to see us continuing arrangements that are very like those that we’re bound by as members of the EU.”

Read more: Trade between UK and EU won’t ‘collapse overnight’ without agreement

With the seventh round of talks over, the next phase of negotiations will take place in London next month with just weeks left until the initial Autumn deadline to complete a deal.

An economist has reminded those fearing the consequences of a no-deal Brexit that trade won’t simply ‘collapse overnight’ if no agreement is reached before the end of the transition period.

Catherine McBride has noted that demand from both businesses and consumers will continue to drive trade and investment between the two sides – though that trade would likely become more expensive with the introduction of tariffs.

She said: “The idea that trade or financial ties between the EU and the UK would ‘collapse overnight’ without an agreement is not something you would expect to read in the financial media.

“Trade agreements do not generate trade – consumer demand, and business suppliers do.

“Trade agreements can make trade easier but if consumers want to buy something, then that demand will be supplied with or without a trade agreement – even if the product is banned by the government.”

“At the very worse, if tariffs are added to products crossing from the EU into the UK and vice versa, then EU-UK trade would merely become more expensive.

“But this would be a bigger problem for the EU than the UK because the UK is a net importer of goods from the EU. It is the UK that provides a lucrative market for EU merchandise.”

Read more: Barnier warns ‘changes are inevitable’ on release of Brexit guidance dossier

Trade negotiations are ongoing but are being hindered by the time and energy required to combat coronavirus with many rounds of talks held over conference and video calls. And while the UK government has struck a number of trade deals with smaller nations, bigger agreements with the US and also Japan, where talks have been held up with a row over cheese, are ongoing.