With the end of the transition period fast approaching on 31st December this year, we still do not have a Free Trade Agreement (FTA) in place with the EU. Some commentators are hopeful one can be reached but difficult obstacles remain surrounding fishing rights and Government subsidies. It is still possible the UK could tumble out of the EU without an agreement.

What would that mean for business and the economy? How important is a Free Trade Agreement with the EU? In this article we will explore this subject in more detail.

A Brief History of Free Trade Agreements

Trade Agreements date back to Egyptian times and were widely used, or rather imposed, by the Roman, Ottoman and British Empires. Bilateral agreements on trade interests really started in the 18th Century with Britain at the forefront in promoting the benefits of open trade. The Great Depression revived protectionism, however, and then came the two World Wars. It was only post WW11 that the General Agreement on Tariffs and Trade (GATT) was signed, initially by 23 countries, with the aim of minimising barriers to international trade by eliminating or reducing quotas, tariffs and subsidies.

This led to the creation of the World Trade Organisation (WTO) in 1995, absorbing GATT. The treaty was signed by 125 countries covering 90% of world trade. Today the WTO has 164 members and reaches 98% of world trade. Its role is to regulate and monitor trade in goods, services and intellectual property between members. It sets agreed maximum tariffs for what is known as Most Favoured Nation (MFN) status. Members agree that they will not discriminate in terms of trade between other MFNs. So, the tariffs they charge are the same for all countries. That is unless there is an FTA in place between two or more countries. Such agreements are allowed by the WTO providing they do not worsen the pre-agreement situation for non-FTA countries.

This has led to the growth of Bilateral FTAs and most recently Plurilateral or Regional FTAs, of which the EU is a complex example.

The Anatomy of a Modern FTA

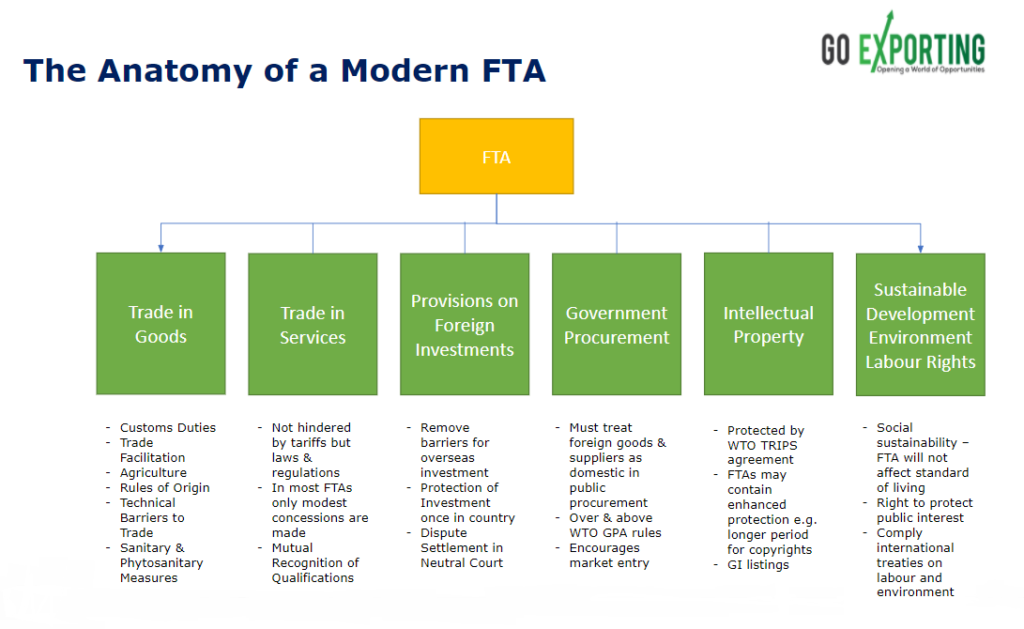

An FTA can be defined as a reciprocal agreement between two or more countries according to international law. It aims to liberalise trade between signatories across substantially all goods and service sectors by easing barriers, reducing or eliminating tariffs and quotas.

The latest FTAs go beyond this however and are often known as Deep Integration FTAs. Good examples are the EU-Japan Economic Partnership Agreement (EPA) and the Comprehensive Economic & Trade Agreement (CETA) between the EU and Canada. Such agreements cover a wide range of topics such as Investment, Intellectual Property, Government Procurement, Technical Standards, Sanitary and phytosanitary standards. The diagram below shows more detail on typical areas covered by such agreements.

As we can see these are detailed and complicated agreements which consequently can take years to negotiate. CETA took 9 years, EU-Japan EPA 6 years, EU-South Korea 9 years, the USA takes on average 5.5 years to conclude an FTA.

What the UK and EU are currently negotiating is this kind of a Deep Integration FTA. Both sides have indicated it needs to be agreed by end of October/early November in order to be ratified in time for the end of the transition period.

On top of that, the UK will not be able to continue to trade with other countries under current EU agreed FTAs. As a non-EU member, the UK is not a signatory. Therefore, it must negotiate its own FTAs with any other country it wishes to trade with on preferential terms.

So, No Pressure!

What is the Importance of FTAs?

Without an FTA with the EU and other major trading partners, the UK will fall back onto WTO rules and tariffs as from 1st January 2021. Compared to the current zero tariffs with the EU, which accounts for around 46% of all UK exports, this could come as quite a shock to many industries. There are over 5200 tariff rates agreed by WTO members, below are a selection of average rates for different sectors.

- Dairy – 37.5 per cent

- Confectionery – 21.2 per cent

- Animal products – 16.3 per cent

- Fish – 11.6 per cent

- Cars and Car Parts – 7%

- Chemicals – 4.6 per cent

- Petrol – 2.5 per cent

- Electrical machinery – 2.3 per cent

- Non-electrical machinery – 1.8 per cent

- Pharmaceuticals – generally 0%

It is clear therefore that outside of an FTA, many UK businesses will become less competitive in international markets due to duties. Agriculture will be particularly hit as can be seen by the tariffs above. FTAs usually lead to significant benefits over WTO rules for this sector. The lack of an FTA will affect both exports and imports, so supply chains will also be a concern.

As we have already seen, deep integration FTAs cover much more than just tariffs, they are designed to reduce barriers to trade too. Without FTAs UK businesses will encounter more red tape for example. Most FTAs agree on simplified procedures for customs, Vat etc. It is already predicted there will be a 6-fold increase in the number of customs declarations required by UK companies. Additional licences and certificates may also be required. This all comes at a cost.

Compliance and product certification will also be an area of concern. The UK has announced it will adopt a new UK Conformity Assessed (UKCA) as from 2021 which will cover most of the same products as the current European CE marking. There will be a CE transition period until the end of the year but after that CE may not be recognised in the UK in the same way. Equally UKCA will not be recognised by the EU. To sell in both areas therefore will require both certifications. Taking this a stage further, CE conformity assessments carried out by UK notified bodies may not be recognised by the EU. It is important to check this point with your assessment organisation.

As we have seen, FTAs always include an agreement on Rules of Origin. UK companies will now have to prove UK origin rather than EU origin for their products. With today’s complex supply chains, this could be more difficult than it sounds. In fact, it is reckoned Rules of Origin is the biggest Brexit challenge for many businesses. See our in-depth article on this subject here.

Is it Make or Break for the UK?

As with all questions of this kind, there is no black and white answer. Many countries do trade quite happily on WTO terms, although the growth of regional trade agreements such as the Transatlantic Trade & Investment Partnership (TTIP), Trans-Pacific Partnership (TPP) and Regional Cooperation in Asia & Pacific (RCEP) makes the number smaller almost by the day.

What is for sure, is that UK businesses will be exposed to higher duties and increased costs in order to comply with new trading terms and conditions. The new normal will be a hard learning curve and some will suffer. UK companies have proven themselves to be resilient, however. Many will find a way.

Brexit will also bring exciting opportunities as well as the challenges. See our special article ‘Brexit: the greatest business opportunity for a generation?’ for more details.

That said, let’s all hope the UK and EU reach a consensus and there is a smooth transition into 2021 and the post-EU reality.

About Go Exporting:

Go Exporting is a specialist export consultancy that launches businesses just like yours into new international markets. As such we have made it our mission to keep exporters informed about the challenges Brexit will bring and provide support services to help them along the journey.

Whether you have a single question or are looking for a full Brexit audit, we offer cost-effective flexible support.

For further details call +44 (0)800 689 1423; email info@goexporting.com