In the event of a no deal Brexit, it could take seven years to re-establish frictionless, tariff-free trade between the UK and EU.

That’s the opinion of two leading EU law specialists who have warned that it might not be as simple as it sounds to simply default to World Trade Organisation tariffs should the UK crash out on 29th March.

Anneli Howard, EU and competition law specialist at Monckton Chambers and a member of the bar’s Brexit working group said to The Guardian that: “No deal means leaving with nothing.

“The UK will need to set up new enforcement bodies and transfer new powers to regulators to create our own domestic regimes.

“Basic maths shows that we will run out of time but any gap in our system will create uncertainty or conflict. Negotiating and ratifying international free trade deals with the rest of the world alone could take over seven years.

“The UK will have to start negotiating over 50 free trade agreements from scratch once we leave the EU. In the meantime we will have to pay tariffs.”

It’s a pretty dire assessment of what could be to come if Theresa May cannot convince the EU to backstop concessions and latterly Parliament to agree to whatever concessions she’s able to secure.

But, naturally, there are some with a more optimistic outlook. Professor of international economic law at City University of London, David Collins remarked that: “The UK can trade quite easily on an uncertified schedule.”

And it’s also worth noting that no deal is still, even at this late stage, possibly still an unlikely outcome. EU negotiations go down to the wire all the time, made apparent by the BBC’s Inside Europe documentary, so we could see a deal agreed at 11:55 pm on March 28th. We could also see an extension to the negotiation period should there be a serious impasse but some light at the end of the tunnel in sight.

You’d like to presume that the government wouldn’t take the UK out of the EU on the morning of the 29th March if both they and the Donald Tusk et al felt another two/three days of talks would see an agreement.

However, it wouldn’t be the first time, second time or even the 100th time that the Brexit process from the referendum to now would have both UK businesses and the population as a whole still clueless as to what’s going to happen next.

Where next for UK businesses

So put simply, we still don’t know where we stand as businesses who rely on the import of goods and export sales. The potential outcomes and routes through Brexit are the same as they were two years ago – deal, no deal or delay. It still seems evident that the prospect of remaining or a People’s Vote with the view to remaining are notions by the wayside as technical possibilities, despite vocal support.

So for businesses looking to prepare for exit, the playing field is pretty much as we were – just with an ever-nearing deadline.

But with nearly half of UK firms not prepared for a chaotic Brexit according to the Bank of England’s most recent inflation report, there is still much planning and preparations to be done for UK firms as Brexit day looms large.

How to plan for the no deal scenario

First port of call is to make sure your business has the right documentation and goods passports in place to continue trading with the EU.

One of these includes an Economic Operator Registration and Identification number, which some businesses will require in order to apply for customs simplifications and to submit import and export declarations.

Read more: UK firms trading with EU urged to apply for EORI number in preparation for No Deal

Secondly, make sure you have enough critical supply of key components should trade and customs disruption follow from the 29th March.

This approach has been labelled fearmongering by some, but for businesses, especially within the manufacturing, food production and pharma industries, it’s critical for operations to ensure that components and parts that are imported from Europe are readily available to ensure no hold-ups in output.

In fact, the same BoE inflation report found that two-thirds of firms it quizzed said they’d begun building up stock and taking out extra warehousing space – and that rate of stockpiling is increasing.

And it’s not just worried businesses that are ensuring key supplies are ready and waiting should disruption occur following the 29th March. After all, it was just this week that it was reported that the NHS was stockpiling body bags.

But perhaps the most important step, and the one you should carry out immediately if not already done so, is talking to your customers on the continent.

Whether you sell the final product or service, or you deliver key components across The Channel, they will be having the same concerns as you are… but they have close neighbours and a local marketplace to turn to for alternatives should they feel the need.

Come Brexit day, the last thing you want to see when opening your inbox, in the event of a no deal exit, is a tirade of emails from key EU customers saying they’ve found alternative arrangements.

So talk to your customers, let them know your own contingency plans and reassure them that your potentially decades of doing business together will not stop because of Brexit, and your company stands ready to make adjustments to ensure as seamless

As Go Exporting CEO, Mike Wilson wrote in an article for Cheshire Media; “It is imperative that you talk with them now to find out their concerns, analyse together where the pinch points may arise and work through a solution. Re-assure them that you are prepared and that they can rely on your company to deliver.”

Still concerned?

Well, you’re not alone. Even those businesses that have invested millions into pre-Brexit planning and contingencies are concerned. But what’s critical is to ensure you have a plan in place to cover all the potential outcomes.

Creating action-plans that can be implemented from the 29th March as the picture becomes clearer is the best way to help safeguard your import-export business in the days running up to Brexit.

If your firm needs support and expert guidance on preparing for Brexit, you can read more about our Brexit consultancy services.

The UK has looked to sure-up its trading relationship with Chile after the signing of a new trade continuity agreement.

Signed by Jamie Bowden, Ambassador to Chile an the Chilean Foreign Minister Roberto Ampuero on 30th January, the deal will see companies and consumers cotinue to benefit from preferental trading arrangements after Brexit.

Trade in goods and services between the two nations has been steadily growing for over a decade, with near 9% annual average growth since the initial agrement was agreed back in 2003.

This continuity agreement will ensure that the relationship continues to prosper with UK expots to Chile having grown some 351%.

The news will be particularly sweet for anyone who bougfht one of the 105 million bottles of Chilean wine sold in the UK last year, with the deal meanning no new tarrifs being itnrduced after the UK leaves the EU.

As well as confirming future trading relations, the deal also allows both British and Chilean companies to bid for certain public sector contracts across the Atlantic.

Read more: Nearly half of UK firms not prepared for chaotic Brexit

International Trade Secretary, Liam Fox said of the deal that: “Today we have signed an important trade continuity agreement as we prepare to leave the European Union. This will ensure there is no disruption to British business exporting to Chile after we leave the EU and will mean consumers continue to benefit from low prices and more choice on supermarket shelves.

“Our trading relationship with Chile continues to go from strength to strength, with exports rising over 20% to almost £1 billion last year. This free trade agreement will allow trade to continue as freely as it does currently and will help to strendgthen our trading relationship even further.”

Almost half of UK companies feel they are unprepared for a chaotic exit from the EU according to the Bank of England’s quarterly inflation report.

The report, which quizzed 200 businesses about their Brexit preparations and readiness, found that half had begun planning for no deal and no transition, but half said they felt unprepared for a cliff-edge scenario.

That’s despite three in four saying they did have some semblance of a Brexit plan in place.

Those we said they were ready still expected disruption over the next 12 months, including a reduction in output and employment.

Worryingly for exporters, just one in five firms said they were taking measures to ensure they had the required documentation in place to continue trading with the EU once Brexit happens.

Read more: UK firms trading with EU urged to apply for EORI number in preparation for No Deal

In what would have been denoted as ‘project fear’ by some, the reality and realisation of what leaving the EU without a deal would look like on the ground for manufacturers and consumer services companies, in particular, has started to hit home, with two-thirds stating they’d begun building up stock and taking out extra warehousing space.

Further research from IHS Markit/CIPS found that UK businesses are stockpiling goods at the fastest pace for nearly three decades, also reporting that export orders had levelled out despite three years of record export growth across UK industries.

Director at IHS Markit, Rob Dobson noted that: “The start of 2019 saw UK manufacturers continue their preparations for Brexit.

“Stocks of inputs increased at the sharpest pace in the 27-year history, as buying activity was stepped up to mitigate against potential supply-chain disruptions in coming months.

“There were also signs that inventories of finished goods were being bolstered to ensure warehouses are well stocked to meet ongoing contractual obligations.”

If your business is one of the many that still feels unprepared for Brexit, find out how Go Exporting can help support your company’s export interests with our Brexit consultancy.

More startups than ever are exporting from the get-go as a core businesses strategy.

In fact, data from the Office for National Statistics show the number of exporting UK SMEs grew by nearly 7% in 2017 compared to the year previously, meaning 10% of all SME’s now export.

Whereas it can be commonly thought to cement a standing in the local market before increasing operations to a global scale, hungry new SMEs are becoming more confident that they can incorporate international trade as part of their first years in business.

Naturally, as a consultancy that helps firms of all sizes profitably expand abroad, we love seeing ambitious new companies looking at opportunities wherever they may lie, and not just planning to slug away at what could be a saturated local territory.

The abundance of free trade deals, enhanced business-to-business technologies and also consumer shopping portals that transcend country borders makes exporting more accessible for new firms (and with some expert guidance along the way to identify markets, research potential markets and map out entry strategies from Go Exporting!).

So, if you have a great business idea, you’ve just opened your doors to customers or your products are already en route to your warehouse, here are three pieces of advice for getting started.

Ask yourself why a certain market

If you already have a certain export market in mind, ask yourself why you’re considering that market. Partly, make sure it’s not a vanity project. For example, you could have visited a certain country and now dream about seeing your product or brand in that territory the next time you visit, and the idea has stuck in your mind.

But great business decisions, especially at such a tender stage in a businesses lifecycle, require more strategic thinking. Yes, it might sound impressive to be able to say to your investors, customers and peers that your product is sold in the likes of the USA and Australia. But your biggest potential customer base and profit potential could be within an emerging market instead.

So, make sure you do your research…

Market research

It cannot be underestimated how important market research is. And that doesn’t mean a quick Google to see if there are any direct competitors already in that market.

How certain are you that your initial ideas for target markets are looking for a product or service just like yours? How open are consumers in that territory to buying international products or adopting a service that could be new to them? How much sales and educational marketing budget may be required? What are the barriers to entry for that market, including any potential tariffs, border checks, a risk of stock theft, financial transaction barriers?

Thorough and detailed market research will help identify potential markets, earmark those to avoid and even give you a list of potential targets for phase 2 or 3 of business growth where additional funding or operational resource may be required.

Map a route to market

In both a literal and business sense, key to a successful export plan is to map out the route to penetrating that market.

Many exporting businesses benefit from forging initial partnerships in export countries to help spearhead initial growth in that territory, including local distributors, trade stockists, local outsourced sales teams and so on.

Read more: 10% of SMEs now exporting

If you’re shipping and selling your own products, remember that space + time = money away from your potential profit margins if you plan to sit your goods in the export territory, so sending a large chunk of your stock to sit in a warehouse for a few months whilst your work out the business and sales technicalities and finding those first customers will likely be a short-term waste of financial resource.

So have a clear pathway, including a list of things that have to be done before any product is shipped or sales push begins in the target country.

Find out how Go Exporting can open a world of opportunities for your business here.

UK exports have risen for a 32nd consecutive month on a 12-month rolling basis, worth £630 billion in the year to November 2018 according to data released this month from the Office for National Statistics.

The continued growth has seen an additional £13.9 billion in value added to UK goods and services exports.

There was marked export growth to territories where the UK has the potential to negotiate free trade agreements in the future too, including the USA, New Zealand, Australia and the Trans-Pacific Partnership zone.

Exports from November 2017 to November 2018 grew by 6.9% o £54.9 billion with the USA, up 2.9% to £5.1 billion in Australia, 3.8% to £869 million with New Zealand and up 4.22% to £28 billion within the CPTPP. Export sales to other markets including Nigeria, India and Thailand also grew by 29%, 27% and 19% respectively.

International Trade Secretary, Liam Fox, said of the latest set of export figures that: “Today’s statistics once again show UK businesses are exporting with more confidence than ever before, as total exports rise to a record high of £630 billion.

“As my colleagues and I have witnessed on ministerial visits up and down the country, businesses are simply keen to continue meeting demand for their produce from all corners of the world.

“As we start the new year, I encourage all businesses to mark 2019 as a year for overseas expansion.”

If your business is looking to start exploring export opportunities or enhance current international trade operations, Go Exporting can help. Find out more about our export consultancy.

UK businesses exporting or importing with the EU have been urged by HMRC to apply for an Economic Operator Registration and Identification number so they can continue trading in the event of a No Deal Brexit.

With Theresa May’s deal set to be voted on by Parliament tomorrow and the rhetoric having advanced to a ‘my deal or no deal’ stage, many large exporting firms have already started enacting their own no deal preparations in advance of the Brexit outcome.

This latest advice, published early December, aims to help ensure businesses are ready to continue operating across borders should the UK exit the EU without a deal.

In such a scenario, it’s more than likely that the same processes that apply to international trade will then apply to any and all trade with the EU as well. However, the requirement for an EORI isn’t required for exporting goods to and from Ireland or across the Northen Ireland – Ireland land border.

Learn more about and find out how to apply for an EORI number here.

British businesses will also require an EORI number in order to apply for customs simplifications and to submit import and export declarations.

Whilst large, global exporting firms will already have an EORI number as a requirement for trading in territories outside the EU, smaller or more specified operations that have only ever traded within the EU block will likely need to apply.

Businesses urging last-minute deal agreement

It will have been nearly three years since the EU referendum that the UK leaves the EU on 29th March, with or without a deal. And for businesses, in particular, as the deadline loomed ever closer, it’s been an uncertain time with millions being spent in Brexit readiness.

And as Theresa May’s deal finally goes to the vote in Parliament tomorrow, bosses at some of the UK’s biggest manufacturers and employers have voiced once again their desire to see a deal agreed in the interest of business certainty and limiting disruption.

Read more: Do businesses really back the current Brexit agreement?

Today, Toyota Europe’s Dr Johan van Zyl reiterated his support for the Prime Minister’s deal, just days after Jaguar Land Rover and Ford announced thousands of redundancies across UK sites.

He said that: “We’ve said since the start of the Brexit discussions that we would like to see trade without any duties or tariffs, and of course we would like to see a regime where the regulatory framework is the same between the EU and the UK.

“That for us is what is really required to make sure that our operations can continue as they are at the moment.

“The big thing about [the] deal that is on the table is that it really allows us to keep our competitiveness. But if we put any friction or tariffs into the system, that will impact our costs and that will affect our competitiveness.”

Is your business Brexit-ready? If not, there is no time to lose to ensure your firm is prepared for any and all eventualities.

Find out more about Go Exporting’s Brexit Consultancy.

The Department for International Trade’s Export Strategy is to be reviewed by the International Trade Committee as part of an inquiry into the department’s support for exports.

Chair of the Committee, Angus Brendan MacNeil, said the inquiry will look to review the strategy and ascertain whether or not it offers ‘sufficient levels of support to UK businesses wishing to export’.

A number of questions have been submitted to the DiT, including whether or not the Government is effectively identifying and resolving market access barriers faced by UK exporters and how effective the GREAT campaign has been at promoting UK products and services overseas.

There are also requests for written submissions regarding the DiT’s view on the effectiveness of UK Export Finance to support companies looking to export and also whether the DiT’s export service in its entirety is fit for purpose and sufficiently resourced.

Of the inquiry, Mr MacNeil said that: “Exports are the lifeblood of the UK economy, and in August, the Department published its new export strategy. Regardless of whether the UK has the ability to strike new trade deals around the world after Brexit, promoting and supporting UK exports remains a core task.

“In this inquiry, my Committee will examine whether the plans that have been set out in the Government’s strategy provide for sufficient levels of support to UK businesses wishing to export.

“We will also be looking at the effectiveness of the ‘Exporting is GREAT’ campaign, and whether the Government has set itself realistic targets, especially given the uncertainty around how the economy will fare after Brexit.”

What is the Export Strategy?

The Government’s Export Strategy was launched in August last year and set to lay the ambitious, visions and way forward to further improve the UK’s export prowess around the world.

In the Strategy, it noted that the UK is punching above its’ weight but below potential and the ambition to raise exports as a percentage of GDP from 30% to 35%.

On Brexit, the Strategy noted that: “Leaving the European Union means we can pursue an independent trade policy for the first time in four decades, which we will use to maximise our trade opportunities across the world and deliver benefits for business, workers and consumers around the whole of the UK.”

However, the level of Brexit advice in the exporting strategy is also set to be analysed, with one of the quests from the International Trade Committee quizzing whether the strategy is sufficiently tailored to markets with particular potential in the post-Brexit trading environment and if it’s fit and ready to resolve the challenges that exporters will likely face due to the new relationship with the EU.

When Theresa May met Chinese Premier Li Keqiang back in January this year, all reports suggest that the meeting was a glowing success. Some £9 billion in deals are expected to have been signed between the two nations as they discussed future trade and investment opportunities between China and the UK.

Indeed, a new ‘golden era’ of trade relationships was entered, as coined and branded by former PM David Cameron.

Later in the year at an Asia-Europe summit in Brussels, Mr Li went as far as to remark in reference to May that ‘your visit to China in January was a big success. We enjoy this golden era and usher in a diamond era’.

So all the platitudes and warm words aside, just how important is the Chinese market to the UK? And vice versa?

Well, China is the UK’s fifth largest export market (by country) with the Asian powerhouse spending over £22 billion last year on British goods and services. Imports, meanwhile, from China were worth over £45 billion according to Office for National Statistics data.

A huge trade deficit for sure, but a vitally important market for the UK establishment and businesses moving forward as a post-Brexit business world takes shape.

And things are headed in the right direction. British exports to China have grown nearly 65% since 2010, despite some stagnation in the last two years.

If China is on the export hitlist for your company, there are some things to consider before entering the market. China may indeed be the largest e-commerce market on the planet, but that doesn’t mean just moving some product into the country will see your firm earn its fortune.

Here are five considerations.

China isn’t just one market

There are often huge regional differences in both business and local government priorities in China, as well as with consumer trends, habits and traditions. So a ‘one size WILL fit all’ approach is more likely to end up costing you money than earning a profit.

A more tailored and staggered approach can, therefore, provide better results by getting to grips with one city or region first before expanding outwards from a successful base.

There are two versions of the Chinese currency

Crucial for exports, China has two versions of its currency with split usage between domestic transactions and international trade. CNY is used locally and is managed by the People’s Bank of China, whilst CNH, used for international trade, is freely tradeable and the two can diverge in value.

Exporters can lose as much as two or three per cent in sales value in some cases, so figuring out whether to use the ban instead of a currency broker to handle exchange rates is well worth considering before beginning export operations in the country.

Appreciating cultural sensitivity will go a long way

Alongside differences in the general populous’ culture, traditions and religions, there are also strong business cultural traditions that go with doing business in China.

This is especially prevalent in business meetings when meeting potential partners, distributors or wholesalers. You can expect to be wined and dined, but understanding the decorum will go a long way to forging long-lasting inter-business relationships. For example, its traditional for the host to offer three toasts before the guest can then offer one of their own.

Getting an introduction will go a long way too

Naturally true of any export venture, but especially due to the distance and cultural differences between Europe and Asia, getting an introduction really can go a long way in helping gain access to desired markets, meetings with critical buyers and gaining trust in the country as a trusted supplier, seller or manufacturer.

CEO of Brandauer, Rowan Crozier advised that: “Our approach has been to develop relationships with UK and European customers that have a footprint in the Far East. As they get to know you and, more importantly, trust you as a technology partner, the opportunities will come.”

British products are in high demand

The ‘Made in Britain’ tag really does carry gravitas in China with both consumers and businesses. It inspires trust in business and is indicative of quality and reliability with consumers, especially in designer goods, fragrances and clothing – even baby formula.

Only Germany and Netherlands export more to China in the EU than the UK, so demand is high but there’s certainly scope to grow.

—

If your business has set its sights on China as part of its export strategy in the future, or you’ve already begun operations in the country and require additional specialist support, find out how our export consultancy can help spearhead your export growth today.

A new survey has found that UK SMEs are still hungry for international trade success in the face Brexit uncertainty.

The research, called the UK SME Confidence Survey, commissioned by OFX and conducted by OnePoll, quizzed 500 UK SMEs owners and senior managers with employee counts ranging from 10 to 249.

It found that 46% of those asked said Brexit had had no effect on their hunger for international trade.

Interestingly, there was a switch in primary market focus too. In 2017, the USA was cited as the most attractive market for exports at 62%, but this year’s confidence survey saw the USA stand at just 36%.

Europe, conversely, fell back into favour with 45% of those quizzed this year suggesting Western Europe was their favoured growth market, compared to just 20% last year.

The OFX report summarised that: ”Again, it seems that Brexit-related uncertainty is no longer holding small businesses back from their EU trade ambitions.

“Despite the uncertainty surrounding the terms of Brexit, small British businesses are increasingly optimistic about international trade.

“In fact, the majority expect to increase overseas sales in the next year. And it’s not all talk. Since 2017, 47% increased overseas sales, growing international revenues by an average of £50,000.

“It’s good to know that political uncertainty hasn’t dampened the spirits of UK businesses.”

Perhaps not surprisingly, business owners in regions favoured leaving the European Union during the referendum in 2016 were most confident and optimistic about international sales now. This manifested itself in the survey results where England-based responders, where the Leave vote was highest in the United Kingdom, were the most confident, with 72% saying they were optimistic about future international trade compared to just 40% of responders from Scotland-based firms, for where the referendum result was firmly in favour with Remain.

Read more: 10% of UK SMEs now exporting

Despite the divisions in future export and international trade confidence though, one thing that united all four nations’ small businesses was the confidence in the ‘made in Britain’ brand. Over half (53%) of those asked said that the ‘Britishness’ of their brand and products was an invaluable asset when selling services and goods internationally.

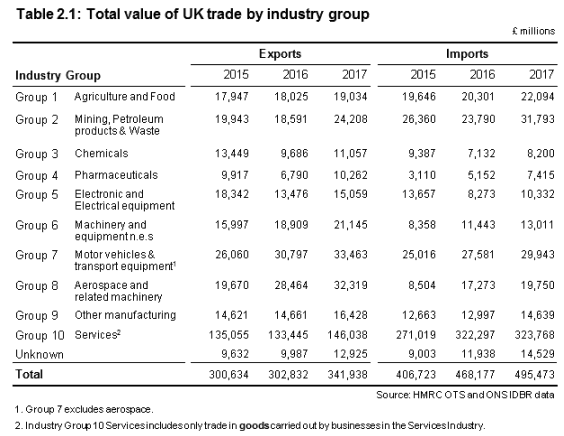

Eight of the UK’s 10 industry groups saw export growth between 2015 and 2017 according to the latest data released by HMRC.

The data, compiled from the Overseas Trade Statistics and Office for National Statistics, found that 151,000 UK firms exported goods and employing some 9.7m staff.

Of the 10 industry groups, just two saw negative growth in export value; electronic and electrical equipment and chemicals.

The largest growth between 2016 and 2017 was seen in the pharmaceuticals sector, followed by mining, petroleum products & waste and aerospace. The chemical industry also saw a healthy increase between 2016 and 2017, offset by a larger 28% decline between 2015/16.

Industries seeing the largest import growth included pharmaceuticals and mining, as well as electronic goods.

(Source: UK trade goods in statistics by business characteristics 2017)

Each and every industry group saw more short-term growth between 2016 / 17.

Business strength in the face of Brexit

This latest data set from HMRC makes for an interesting read, and a positive one too.

Firstly, whilst some sectors including most notably chemicals and electronics saw marked declines between 2015/16, every sector experienced growth thereafter. That’s despite the EU referendum result in late June of 2016 and ongoing uncertainty and negotiations the year after.

Stalwarts of UK industry including aerospace, pharmaceuticals and vehicles continued to see growth – a positive sign before the UK officially leaves the EU in March next year.

Overall, the total value of exports saw an extremely healthy 13.7% growth, highlighting both the ambition, confidence and success of exporting UK firms throughout the Brexit process.

And despite one in 10 UK SMEs now exporting around the world, 72% of the total value of exported goods is generated by a smaller percentage of more experienced firms over 20-years-old.

Read more: 10% of UK SMEs now exporting

This data, combined with other further data released recently as part of the Annual Business Survey, shed a positive light on the UK’s international trade and the increasingly international outlook for SMEs and start-ups too.

(Image by Pkuczynski)